CSX Earnings Review

CSX is going to need something harder than rainbows and butterflies from customers to show its strategy is succeeding.

CSX reported earnings last week. I don’t know that there was a lot of optimism coming into the call. Sure enough, CSX missed on everything:

The great Rick Patterson highlighted the service deterioration at CSX in his Railway Age article,

“System velocity fell another 0.3 mph to 21.9, a new post-2022 low. Intermodal velocity was sequentially flat, but average train speed for the manifest, coal and grain networks all softened. Terminal dwell similarly deteriorated in sequential weeks, from 24.4 to 24.7 hours, and we’re now within one hour of where it peaked during Hurricane Helene last year…

“A decelerating railroad acts like a giant magnet, sucking in more train crews, locomotives and railcars to move the same amount of freight. The problem is that the railroad only truly controls the first two: crews and power. Most of the cars are owned or leased by the customers, and to ensure adequate deliveries of product, they throw more assets onto the system as it slows, which increases congestion and slows it even more. It takes a long time to reverse this process. The railroad first has to adhere to the First Law of Holes—stop digging, and once the system is stabilized, marketing and operations then need to work the phones to cajole frustrated and reluctant customers into pulling some of their cars off the system. It’s basically a “trust me” moment. Some customers will (due to good service in 2023 and 2024), and some won’t (2022 still too fresh in their minds).”

This wasn’t a total surprise. We knew the Howard Street Tunnel was going to impact service. Q1 always contains weather surprises, like the flooding in Tennessee and Kentucky that CSX has been dealing with. What’s perhaps most concerning for CSX is that over the past few quarters you haven’t gotten the sense that there’s any real sense that CSX is control and capable of reducing the excess inventory in the system.

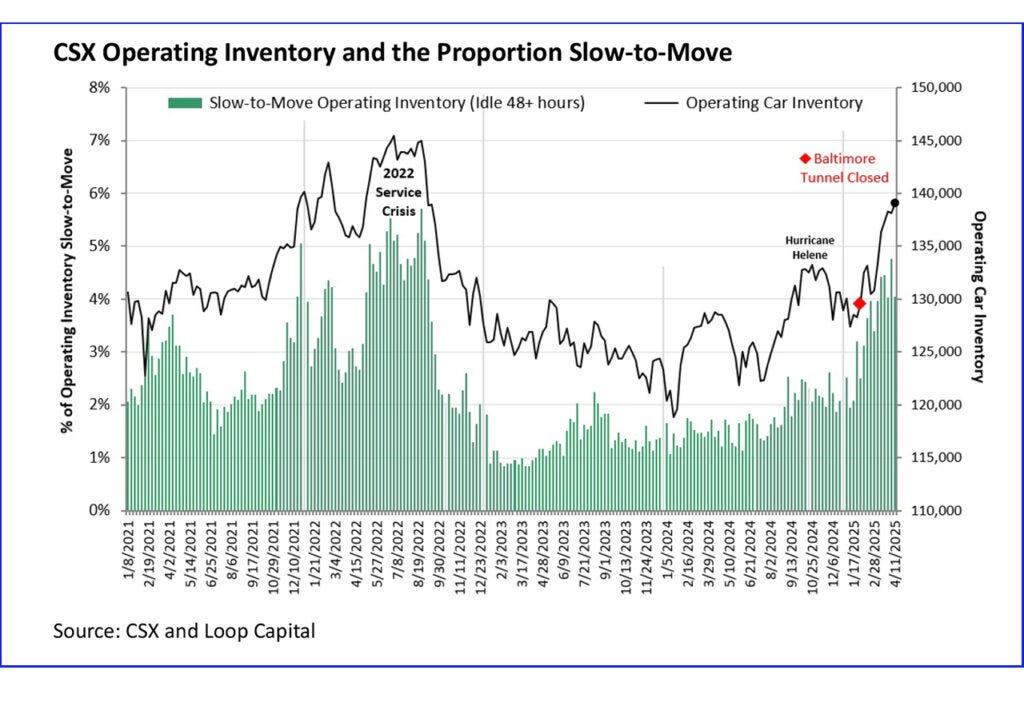

Rick Patterson’s chart below shows a railroad that’s been heading in the wrong direction since it bottomed out in Q1 2024.

Credit to Joe, Mike, and the rest of the management team with not sugarcoating the issues. From the beginning of the call, they were candid and honest. It’s hard to know exactly what the condition of CSX’s operational health is given they’ve been handicapped since Hurricane Helene and now they’ve got the Howard Street Tunnel project diversions for the rest of the year.

I highlighted in the past that, when pressed on the operational issues, CSX’s management team indicated high levels of customer satisfaction despite deteriorating service metrics. In other words, traditional service metrics like train speed or dwell were no longer the appropriate method for evaluating their business. I’m here for that line of thinking given that using these metrics for the past two decades hasn’t produced one iota of carload growth or unlocked truck conversions.

But where’s the results that support the alternative narrative? It’s not like CSX has healthy volume growth to back up the happy customer story. In fact, 2024 volumes were the worst since 2020 and show a continued slide that doesn’t indicate they’ve been able to find the escape velocity that has plagued industry growth for the past two decades.

Maybe the underlying growth is there and its just being masked by a tough macro environment and extra, short-term operational hurdles. Cool cool, but CSX is going to need something harder than rainbows and butterflies from customers to show its strategy is succeeding.

Why Do We Do It This Way?

I also want to highlight something here that seems like a big missed opportunity for all railroads, not just Class 1’s and not just CSX. On the call Joe highlighted some of the process CSX is using to target their bloated car inventory:

“We're working really close with our customers to identify, first of all, the excess cars in our serving yards and our active inventory. And then we're working with them where we can to provide extra service to work these cars off. And then also providing enough service of understand and can reduce their pipelines to help us create the fluid that we need.”

I could be wrong, but when I hear, “we’re working really closely with our customers,” I translate that to mean, “Our account managers, yardmasters, etc. are on the phone with our big customers to have open dialogue about what we have in inventory, what they have in production schedules, and how we can work together to find a good outcome as we reduce our inventory.”

Let’s imagine just for a minute it’s not the 1970’s and we actually have a few more tools at our disposal than just a telephone. This is where my argument that Class 1’s should be giving away GPS devices to their customers comes into play. (I’ve written about this multiple times, but I still don’t think folks grasp the concept).

Before any sales manager or yardmaster/trainmaster picks up the phone to call the customer, imagine those key personnel know exactly how many cars a customer has in their yard. They also know the current loading rate of cars at that facility along with the loading rate for the past week, month, year, 5-year average, etc. Deviations from the average are flagged immediately. They can see which shift loads more frequently. There’s a number of customer or location specific characteristics that could be identified once you put GPS on railcars.

Now, you may be thinking, “This is nonsense. We already know all that about Customer XYZ.” Maybe. I would argue it’s locked up in old Clem’s head who’s worked at your location for 30 years and is going to be lost once he walks out the door, but sure, let’s say your crews know the characteristics of local customers. And how many times do your crews show up to pull a string of cars or set one in only to find out the customer isn’t ready/can’t receive them? How much time and resources does that waste?

Do your operating teams know the details of every customer on the network? Railroads do track maintenance and linehaul operations well at scale. What they don’t do well at scale is customer service.

How much sandbagging goes into demand planning and forecasting today? Are the intimate details of customers communicated or known to other areas of the organization that may need to know that information? Can they be communicated automatically through mindless systems that don’t rely on phone calls to relay information? What if your customers didn’t have to call/email/text to find accurate information they could get from a glance at a screen?

It’s situations like the one CSX is experiencing that the railroads could really benefit from a real-time, continuous feed of demand planning information that only GPS (not CLMs) can provide. It’s time for railroads to stop hiding behind a bunch of lame excuses and lies they’ve told themselves for years about sharing data with customers. Show them everything. Integrate deeper into their operations and allow them to do the same. Manage their carload inventory by delivering just enough cars to feed their process, not the extra 20% they ordered because they were sandbagging.

I stand by my claim that there’s so much ROI here railroads would be money ahead by giving devices away to their customers.

Tariff Impact

CSX CMO Kevin Boone also said something about the impact of the tariffs that stood out to me:

“I think you can see a lot of benefits from decoupling from China that can benefit the East Coast, potentially, and we're watching that and making sure we're staying in front of it, both with our investments and how we're thinking about that and really working with our customers to position them so they can capture the markets as they change.”

Let me first put out there that I think the odds of a reindustrialized US are remote. Don’t get me wrong, we’re living in the age of the greatest amount of industrial policy in 100 years. We’ve seen quite a few announcements of increased manufacturing capacity for the past 4 years, not just since President Trump took office. Things are changing. Freight flows are changing. (TBD if they change in such a way to benefit railroads).

But I don’t think we’re going to see a massive reindustrialization of the US. I still think Mexico is going to be a vital partner for the US going forward as long as they can maintain a lower labor rate basis.

I also think Treasury Secretary Scott Bessent’s recent comments today are instructive. From the CNBC article reporting on a closed door meeting between Bessent and Wall Street,

“Bessent also insisted that, despite the U.S. ratcheting up tariffs on Chinese imports to 145% and China retaliating with 125% duties on American goods, the goal of Trump’s policy ‘isn’t to decouple.’”

If it wasn’t obvious already, President Trump’s style is to shoot for the moon, land well below that, and claim victory on whatever gains he’s able to generate. These changes in trade policy and any bilateral trade deals that come from his tariff bazooka will likely be positive for US freight flows. It will reduce our trade deficit and, hopefully, result in reining in the mercantilist policies of Asian countries that will lead to benefits in global competitiveness for US firms.

So what does that mean for CSX and the other Class 1’s? I think it’s unlikely anything good in terms of imports. Auto imports from Europe, for example, aren’t going to do well. Some people will still love the status symbol Audis and BMWs, but expect fewer Jettas.

The Class 1’s that do have exposure to Texas, Ohio, Tennessee, the Carolinas, etc. could potentially see an uptick in domestic demand from new factories. I would echo Kevin’s optimism in those cases.

However, one big caveat for new sites is that if you were to locate a new factor today, would you put it out in the sticks on a rail line captive to a Class 1 or would you put it somewhere with multiple Class 1’s, good access to interstates, and even better access to end markets? What the railroads may find is that a lot of these new sites may not have the length of haul that makes them attractive to a Class 1. Nor will they be able to command the margins that they’ve been able to through years of consolidations.

New demand for freight transportation is a great thing. Just don’t expect it to look the same as it did before.